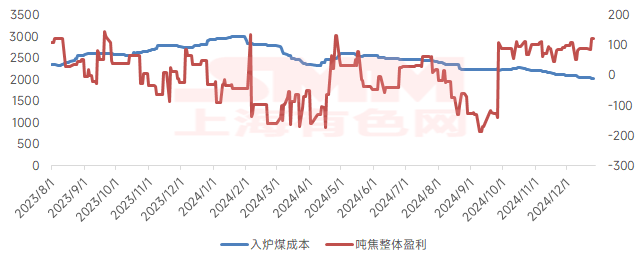

1. According to the SMM survey, the average weekly profit per ton of coke was 112 yuan/mt this week, and the overall profitability of coke enterprises improved.

From a price perspective, coke spot prices remained stable this week, and the profit and loss per ton of coke for coke enterprises was not affected by price changes. From a cost perspective, the prices of major coal types all declined this week, with a decrease of 30-80 yuan/mt. Low-sulfur primary coking coal and other key coal types remained basically stable at 1,400-1,640 yuan/mt, leading to a reduction in coking costs and an improvement in coke enterprises' profitability per ton of coke.

Coke prices are expected to decline further. Even though coal mine transactions remain sluggish and coking coal prices still have downside room, it will be difficult to offset losses. Next week, the profitability of coke enterprises may narrow.

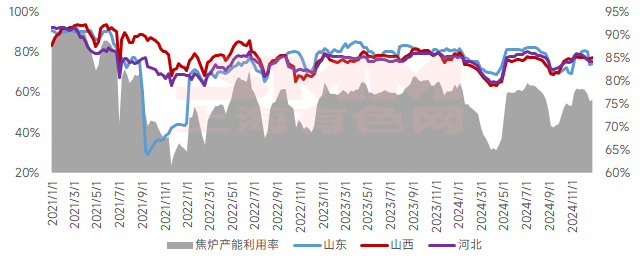

2. According to the SMM survey, the coke oven capacity utilization rate was 76.0% this week, up 0.4 percentage points WoW. In Shanxi, the coke oven capacity utilization rate was 77.1%, up 0.5 percentage points WoW.

From a profit and loss perspective, the profitability per ton of coke improved this week, and coke enterprises maintained high production enthusiasm. Even if profitability decreases in the future, large-scale losses are unlikely, and overall production remains basically stable. From an inventory perspective, coke inventories at coke enterprises saw a slight inventory buildup this week, but sales were moderate, with no significant inventory pressure. From an environmental protection perspective, only Shandong strictly enforced environmental protection policies, but most coke enterprises in Shandong voluntarily reduced production, with minimal impact on supply.

In the future, most coke enterprises are unlikely to see expanded losses and are expected to remain profitable. Coupled with relatively small inventory pressure, the coke oven capacity utilization rate of coke enterprises is likely to remain stable next week.

3. On the supply side, the profitability of coke enterprises improved, and sales were moderate, with relatively small inventory pressure, allowing them to barely maintain normal production. Coke supply fluctuations were relatively small. On the demand side, steel mills saw a slight increase in their coke inventories, combined with a decline in pig iron production and the fifth round of coke price cuts, leading to a low willingness to restock coke. On the raw material side, coke enterprises recently accumulated some coking coal inventories, with low restocking willingness, and coking coal prices still have downside room. In summary, the fundamentals of coke remain slightly loose, with weak cost support. The expectation of coke price cuts persists, and the coke market is likely to fluctuate downward next week.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)